Stocks have had a rough go of it. The S&P 500 has gone down 7.5% in the past two weeks and change, even after yesterday’s rally. The common narrative is that news of surprisingly high wage growth spooked investors. After all, wage growth could fuel high inflation, and high inflation could lead the Federal Reserve to raise interest rates, thereby making stocks less attractive. Wary of inflation, some investors are turning away from stocks in favor of other alternatives.

The reaction to degree inflation hasn’t been nearly as dramatic, but it could be even more significant. As the job market reconsiders the value of bachelor’s degrees versus other credentials, many traditional four-year colleges and universities have reason to worry.

Degree inflation: a primer

The bachelor’s degree has long been accepted as a signal of specialized skills and suitability for positions with more responsibilities or higher cognitive demands. However, in the past few decades, employers have increasingly demanded four-year degrees for low- and middle-skill jobs that non-degree holders are already doing well. This phenomenon, whereby employers list as a prerequisite credentials they don’t need, is known as degree inflation.

Recent research from Harvard Business School highlights the deleterious effect degree inflation has on the middle class in particular, increasing underemployment and keeping millions of less-credentialed, but qualified, individuals from participating in and bolstering the economy. Degree inflation also inflicts considerable hidden costs on the very employers that perpetuate the practice, lengthening time-to-hire, increasing turnover, and increasing labor costs unnecessarily.

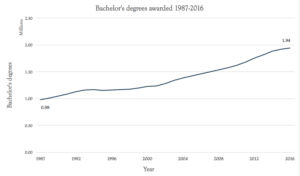

Not that traditional higher ed is complaining. As the main suppliers of bachelor’s degrees, four-year colleges and universities have benefited tremendously from the general association between more lucrative employment and their most popular product. Between 1987 and 2016, the number of bachelor’s degrees awarded almost doubled, while tuition and fees increased more than fourfold at four-year institutions in that same span.

Growing wary of degree inflation

There are signs that the landscape is getting complicated for many higher ed institutions, however. Since 2011, undergraduate enrollments have declined, and those skyrocketing tuition numbers have drawn increasing criticism while generating only meager increases in revenue.

In the meantime, a stubborn skills gap has kept 6.6 million Americans unemployed despite 5.9 million job openings. Puzzling, given the tightening labor market. This has led government agencies, employers, and researchers like those in the Harvard study to take a closer look at degree inflation, and many of these stakeholders are already taking steps to reverse the trend. If their efforts are successful, they might end up diminishing overall demand for bachelor’s degrees, exacerbating traditional higher ed’s struggles.

For example, the federal government has been touting apprenticeships and Career and Technical Education (though proposed budget cuts say otherwise), echoing the chorus of researchers calling for more pathways to associate degrees and other certifications. The Harvard report cites several examples of prominent employers like CVS Health and JPMorgan Chase taking steps to hire more workers that don’t have bachelor’s degrees.

Innovative entrepreneurs are also getting in the game, finding faster and cheaper ways of providing learners with the specific skills they need for specific jobs. They often use alternative credentials to signal these skills to employers, sidestepping traditional postsecondary degrees altogether.

What this means for traditional institutions

Traditional, four-year universities can no longer rely on their current business model, hiking tuition and hoping everyone still sees the degree as they always have. The business model costs too much, and its return-on-investment is weakening. Increasingly, the traditional bachelor’s degree is seen as an ineffective signal of what employers need.

How can traditional schools adapt? Disruption Theory provides some suggestions. First, as the traditional college experience has become increasingly expensive and bloated, job-oriented learners have become increasingly overserved—meaning they are paying more than they’d like for more than they need, and would gladly pay less for something more affordable and convenient. This especially applies to so called “nontraditional” students, older adults returning to college hoping to improve their job prospects. These overserved customers are prime targets for disruptive approaches.

Traditional colleges and universities can look to several examples of innovators who reshaped their business model and their value proposition to better address the needs of these overserved learners. In the short term, this could include providing a wider variety of traditional credentials like associate’s degrees, certificates, or professional certifications. As the growing concern surrounding degree inflation leads business and government agencies to emphasize credentials other than the bachelor’s degree, traditional institutions would do well to diversify their offerings.

In the long term, institutions with an eye for disruptive trends will also notice a new value chain growing around competency based education (CBE). Disruption Theory teaches that disruptive entities seek to improve along entirely different performance metrics than existing providers. While traditional colleges and universities focus on prestige, CBE providers focus on helping learners master specific skills on their way to a job. Schools like Western Governors University and Southern New Hampshire University have experienced tremendous growth and success by offering CBE to nontraditional learners.

Entering ‘market correction’ territory

Market fluctuations play out much more gradually in higher education than they do in the stock market, but that doesn’t mean they’re not happening. Degree inflation has been operating for decades now. Awareness of it has dawned gradually as the labor market has tightened. As a result, degree inflation is slowly showing signs of reversing. Traditional institutions that ignore these changes do so at their own peril.

Traditional colleges and universities have their work cut out for them. They must start educating a more diverse student body, and will need to learn how to teach and signal relevant skills more effectively in an ever-evolving labor market. We are bullish on the schools that are willing to reevaluate their business model, applying the principles of Disruption Theory. The rest may find themselves on the wrong side of a sell-off.