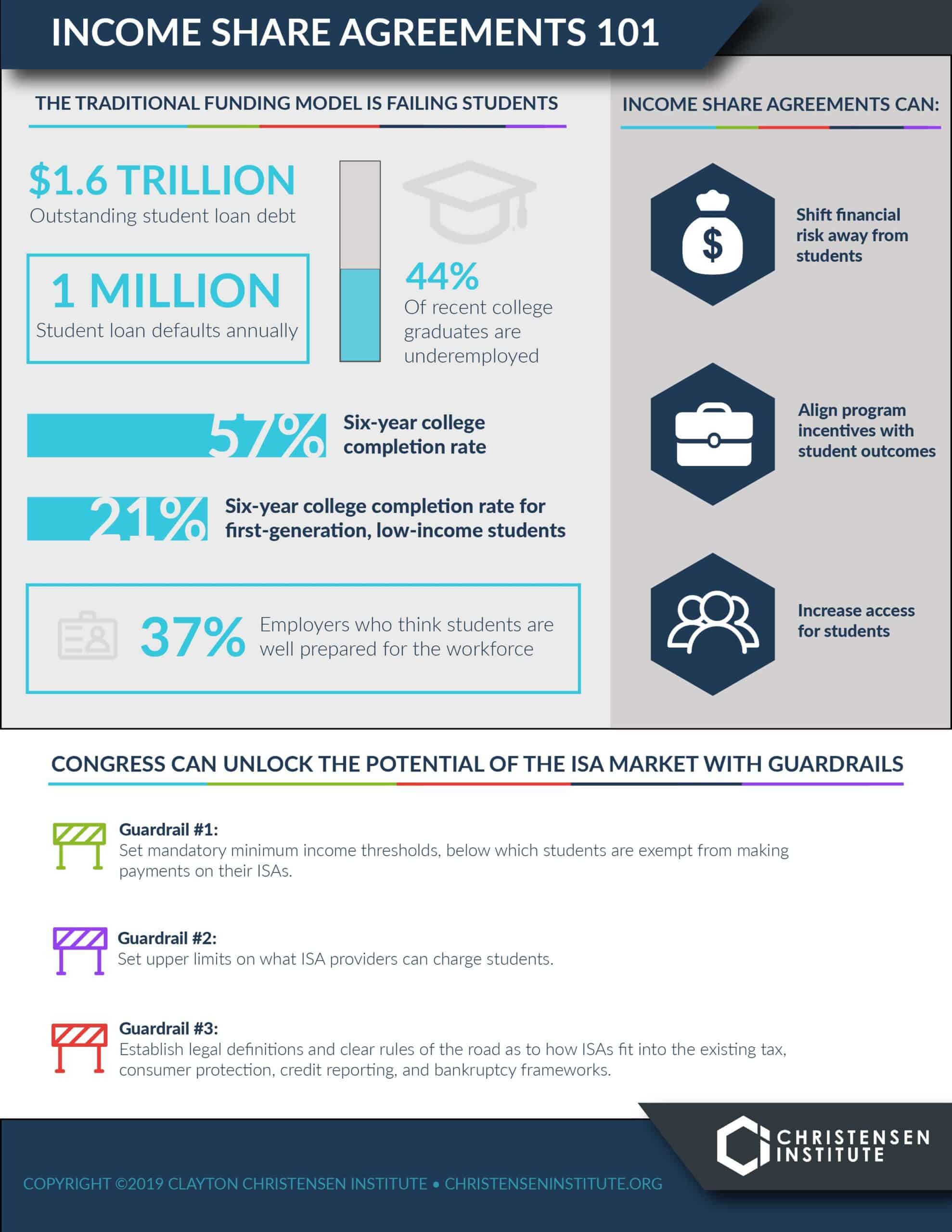

One million borrowers default on their student loans every year—a terrible testament to a financing model that is inadequate for our increasingly complex higher education system. Income share agreements, or ISAs, allow students to fund today’s educational opportunities in exchange for a fixed percentage of tomorrow’s income. They protect students against poor workforce outcomes, shifting that risk to schools and incentivizing the latter to better prepare their students for the labor market. Redistributing the risk of poor outcomes has the potential to redefine the value of college.

However, the lack of a regulatory framework for ISAs has been a significant hurdle to realizing their full potential. Legal assurances of student protections and clarity around issues like tax treatment and dischargeability in bankruptcy are crucial to the ISA market.

The higher education financing system could use another tool to address the needs of those for whom existing solutions aren’t working. We welcome ISAs as just such an innovative addition to the toolbox, and encourage Congress to do the same.

To find out more, read our policy brief, “Unlocking the potential of ISAs to tackle the student debt crisis.”