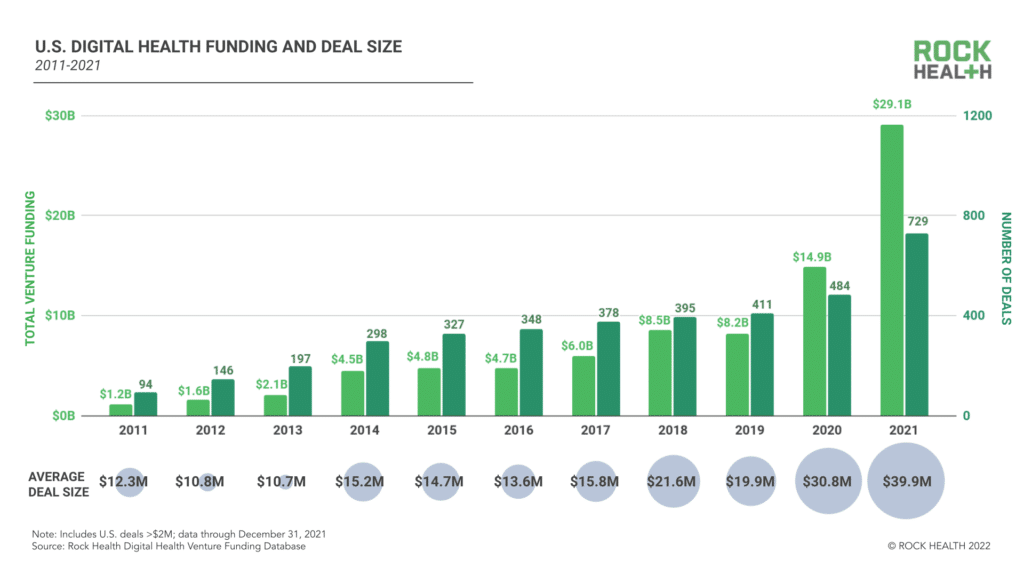

Digital health is in the midst of an investment boom, or what some may consider a bubble. Rock Health’s chart of total funding articulates the massive amount of capital chasing digital health startups. In 2021, U.S. digital health funding topped $29 Billion. Yes, that means it almost doubled total funding from 2020, which already crushed all the prior years’ totals.

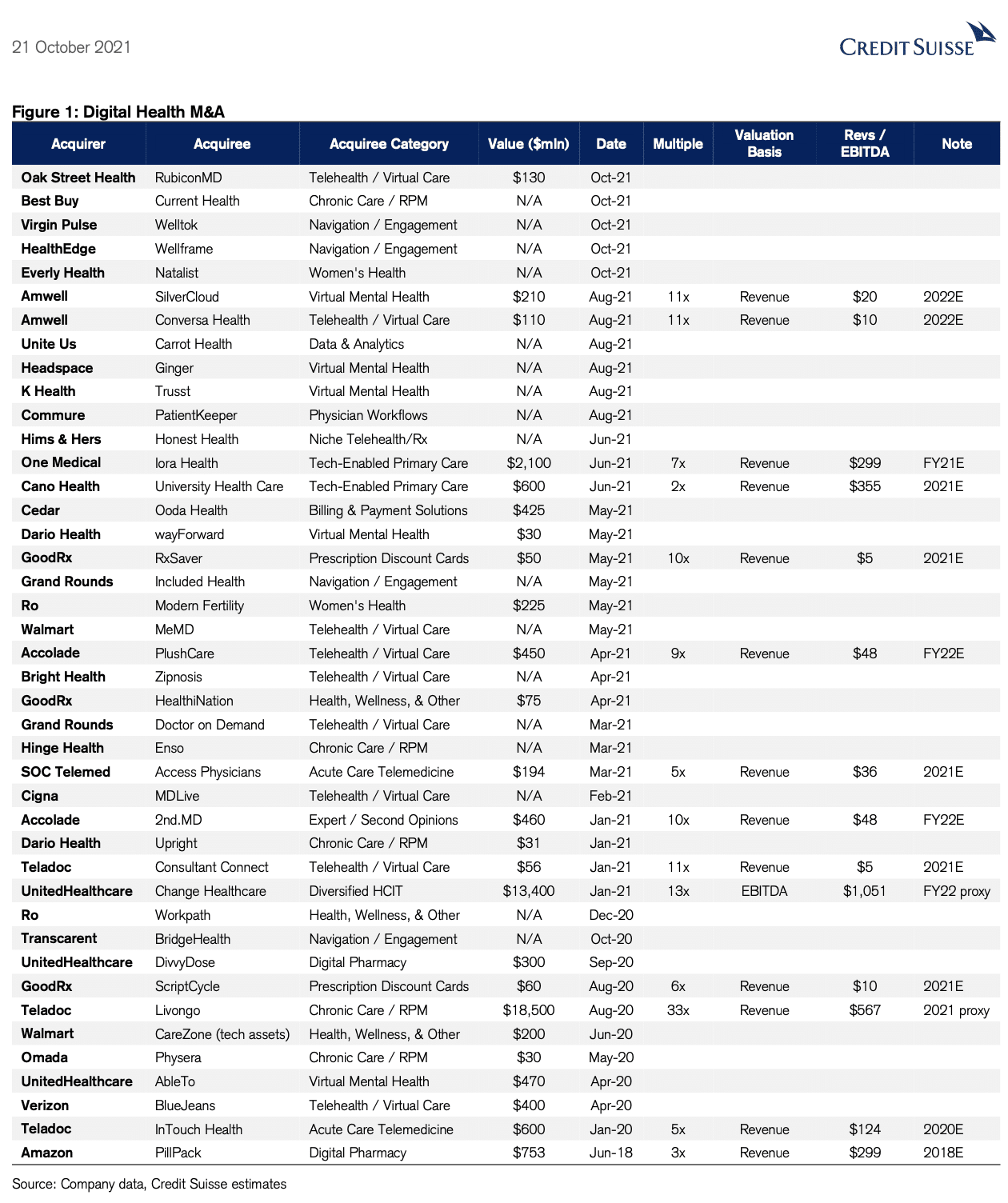

With so much funding behind so many models, the market is oversaturated with a proliferation of point solutions. And each one only solves one or two components of the total health problem. As a result, a great consolidation is starting, as organizations assemble disparate solutions into platforms that can meet a range of individual and employer needs. This table from Credit Suisse shows the rapid pace and rich valuations of digital health M&A over the last two years.

The reality of M&A

Unfortunately, the majority of mergers fail to create the value acquirers intend, and the same is likely to be true in digital health M&A. As consolidation continues, the industry is just as likely to see value destruction rather than value creation.

The reason, as Clay Christensen’s theories explain, is that many leaders misunderstand the true value of their acquired assets and mistakenly integrate them into their core business model when they should in fact keep them separate. They believe they are acquiring assets that will improve – and thus fit into – their existing business model, when the true value the acquired firm provides is its potential to enhance long-term growth. In this latter case, the two businesses are complementary but not compatible. As a result, the acquirer mistakenly destroys value by combining resources, processes, and priorities that should not be meshed into one business model.

Three steps to maximize value creation

To ensure this latter case is not the norm, digital health needs an M&A playbook. It’s critical at this junction to create value as the platform wars continue. At a high level, the playbook is a three-step process of “why,” “what,” and “how”:

1. Start with “why”: Both the acquirer and the acquired must have clarity around the driving force for the purchase and align on the vision for the combined firm. As part of this process, leaders should answer these questions:

- Is this a deal to improve current operations, or to enhance our long-term growth?

- What assumptions must prove true for this purchase to create value?

- How likely are they to prove true?

- How will we test those assumptions?

Leaders should take a discovery driven planning approach to enhance their likelihood of a successful merger.

2. Understand the “what”: When in the midst of a merger, it’s natural to turn thoughts inward, focusing on your own organization. Leaders must counter this tendency and stay grounded in the demand-side perspective. They must focus on the individual firms’ customers and those of the new combined entity.

As leaders seek to understand what progress they help their customers achieve, that is their jobs to be done, they must be careful not to mistakenly assume customers of company A will have the same jobs as customers of company B. While they may have similar or compatible jobs, they may also have competing jobs, which will not make it easy for a combined company to sell both products or services to both sets of customers. This was the case with the recent Teladoc Livongo merger. Both organizations sell their solutions to insurers and employers, and upon combining, they only had a 25% overlap in their clients. Teladoc assumed it could sell Livongo’s solutions to its existing customers. But many insurers have their own chronic condition offerings. So Teladoc’s attempt to sell Livongo’s programs, which compete with some insurer’s home-grown solutions, was off-putting and unsuccessful.

3. Based on why and what, clarify “how”: In cases where an acquisition is more focused on disrupting the industry or when there is a conflict in jobs as noted above, the acquired organization should not be integrated directly into the acquiring company’s business model. If it is, more value is likely to be destroyed than created. This is due to the fact that the true value of the acquired firm lies in its disruptive potential, which will be crushed by the core business model of the acquiring organization if the two models are combined.

In 2022, I hope we see acquirers test out this playbook. To do so, they can 1) clearly state why they are acquiring a firm (improve operations or change their growth trajectory), 2) clarify what customers hire them and the acquired firm to do, and 3) clarify how they should integrate their business models – or not. These are three critical steps towards value creation.