With the start of the new school year just around the corner, prospective students are asking what has become a very tough question: Should I go to college?

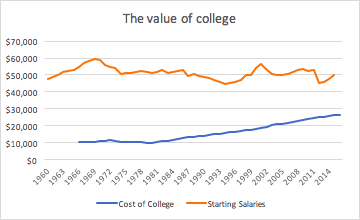

It used to be easier to give a clear answer. In 1970, first year starting salaries for college graduates would more than cover the full cost of four years of college. This is no longer the case. Adjusted for inflation, the salaries of college graduates are more-or-less flat since the time that baby boomers first began crossing the commencement stage. The costs of college, on the other hand, continue to creep higher.

This has led to tough consequences for the millennial generation—which is now more educated than prior generations, but struggling with debt and taking the slow road to household formation.

Is college worth it, at today’s cost and in today’s economy?

Only if you graduate

The start of college is full of excitement: new roommates, dorm furniture, classes carefully selected. But the end of college is often far less climactic than the commencement speeches might have you believe: over 40 percent of students who enroll full-time at four-year institutions won’t graduate in six years. The rates are dramatically worse for students who enroll part time.

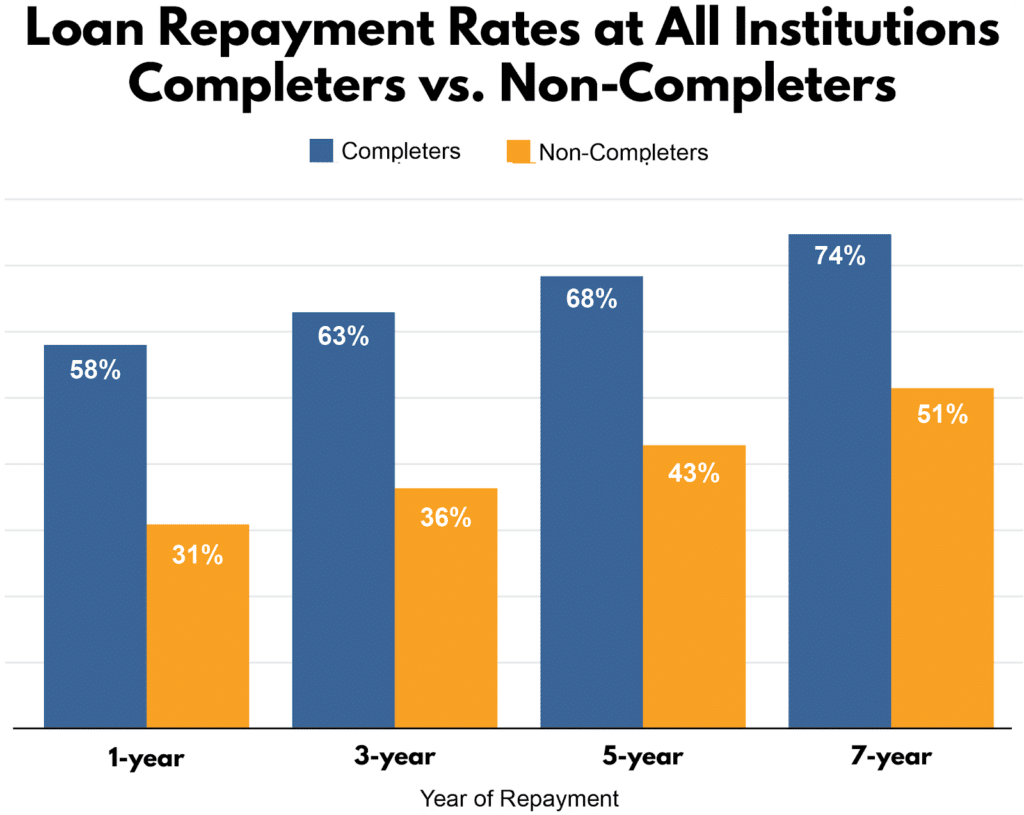

A new report from Third Way demonstrates the consequences: students who don’t graduate have a very tough time paying back their student loans. After seven years, only half of those who had started college and not finished had made a dent in paying down any principal on their student loans—meaning they owe more seven years after leaving college than they did on the day they dropped out.

Worth noting: the data aren’t that great for those who do finish college. Over a quarter of college graduates owe more on their loans after seven years than they did at graduation.

It depends on what you major in

While students pay the same tuition regardless of whether they major in computer science or art history, employers will have a different view of the value of the degree. Indeed, the decision about what to major in could matter more than the decision to go to college at all. Analysis from Georgetown’s Center for Education and the Workforce shows that the lifetime difference in earnings between majors can be as much as three times as large as the million dollar difference in lifetime earnings between those who go to college and those who don’t.

The top earning majors are predictable: STEM degrees and finance tend to have the higher payoffs than humanities and arts degrees, and engineering degrees pay the most. These differences in earnings also drive differences in student loan repayment rates by major. College majors are not created equal, even though they may cost the same.

If you treat it as an investment

On average, a college degree matters more than ever to long-term career success. But since a college degree also costs more than ever, students should plan carefully. College enrollment isn’t a one-way ticket to success, it’s an investment that needs to be managed carefully.

Students take tests, fill out forms, write essays, submit transcripts, and jump through the hoops of the college admissions process. But students should make a rigorous evaluation of their college options as well. Schools vary dramatically in their outcomes: student retention, graduation, earnings, and satisfaction. While data on outcomes is often buried in glossy marketing about modern dorms, sumptuous meal plans, recreational activities, and campus amenities, it’s worth it for students to search for it. Tools like the College Scorecard are imperfect, but they offer important information to students not always advertised by schools.

After students arrive at school, they should start with the end in mind: a clear view of the desired degree, the requirements to get there, and a semester-by-semester plan of how to meet those requirements—can save students money and valuable time. The average college graduate has earned—and paid for—more credits than they actually need to graduate. Remedial coursework requirements shouldn’t be approached passively: these courses are expensive (to the tune of $7 billion annually) and have high failure rates. Colleges themselves often aren’t the cheapest or easiest places to complete these requirements. Options like Modern States or Straighterline can be better, faster, more flexible options for some students to complete general education requirements.

Making the most of college requires students to layer in experiences alongside their degree as well. As Jeff Selingo writes in Life After College, “While some sort of degree after high school remains the foundation of a successful life and career, other coming-of-age, real-world experiences in the late teens and early twenties—particularly apprenticeships, jobs, or internships—actually matter more nowadays in moving from college to a career.”

Final answer: it depends

While there are plenty of good jobs that don’t require a college degree, on average, college degrees pay off. But averages are tricky—there are plenty of college dropouts and college graduates who consider themselves worse off for having enrolled, just as there are plenty of successful professionals who could never have made it without a college degree. Graduation may seem like a world away, but planning for it now can help students to put themselves on the winning side of the whether-to-go-to-college calculus.