Over the past couple of years, I have been fortunate to teach a class–Entrepreneurship and Market Creation in Emerging Markets–at the Kellogg School of Management at Northwestern University. One of the cases we discuss in the class centers around how an entrepreneur should go about solving Mexico’s diabetes crisis. Today, one in six Mexicans suffers from diabetes and almost half the people living with the disease are undiagnosed. In addition, approximately 44% of Mexicans live below the national poverty line, and the burden of this disease costs the government billions of dollars annually. The consequence is a country where tens of millions of people are not only suffering from the effects of poverty, but also from this painful and deadly disease. (Diabetes killed almost 150,000 people in 2020)

Naturally, the first question I ask the students is: how should the entrepreneur go about solving this problem? Should he build a nonprofit or a for-profit company?

After much debate, the general sentiment in the class is that a for-profit company would be a better solution to tackle this problem than a nonprofit. But why? And more broadly, why is profiting from and with those who are poor a much better way to solve the problems that plague many poor people today?

Here’s a point of clarification before I answer. To profit from people does not mean to exploit them. It simply means to create so much value for them that they are willing to hand over some of their most precious resources (their money or their time) because the value they receive is more than worth it.

Four reasons for-profit organizations are better suited to solve poverty problems

The source of capital

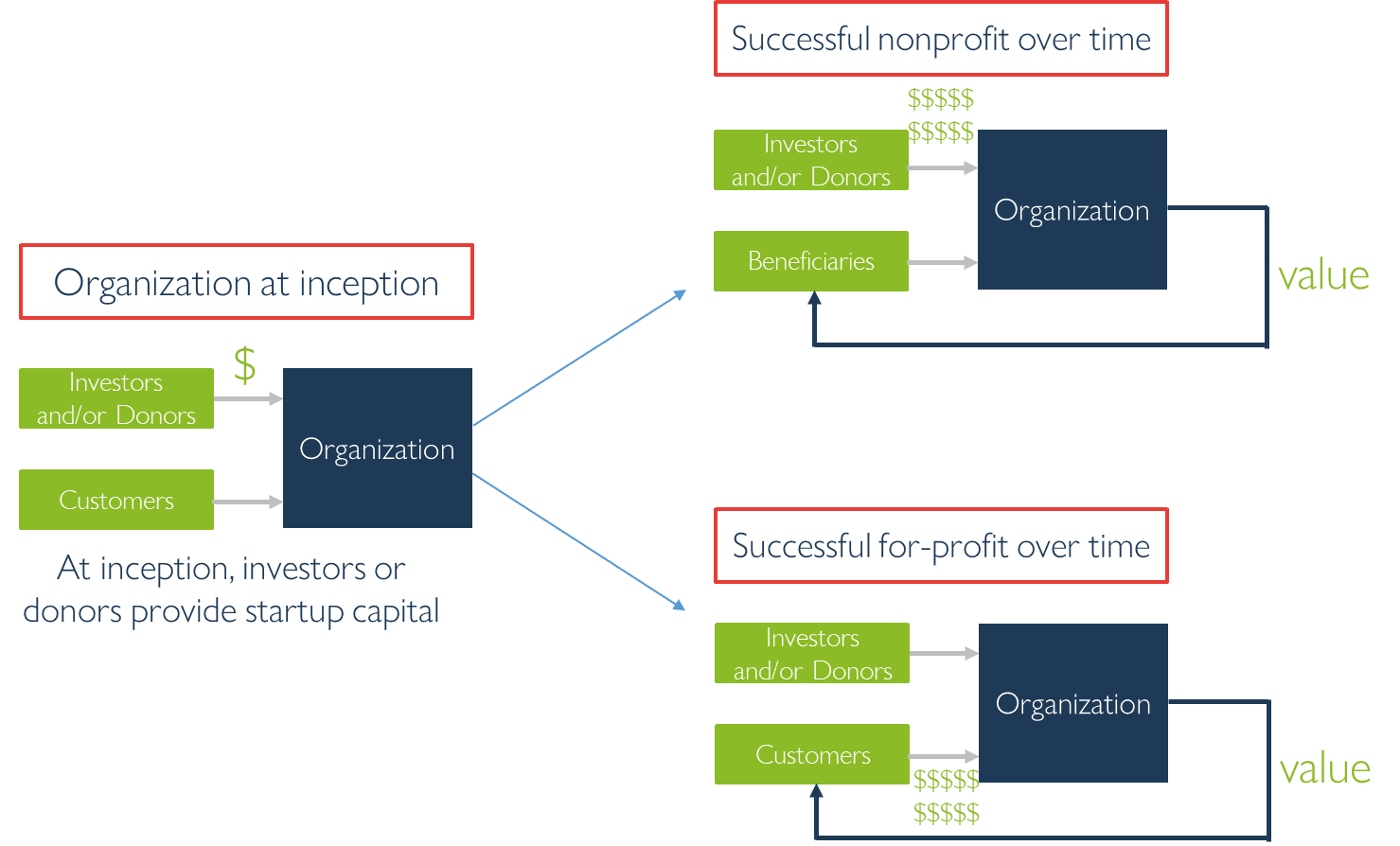

Every organization needs capital to function. Capital is necessary to pay salaries, purchase equipment, and provide services to customers or beneficiaries (in the case of nonprofit organizations). Every organization gets its capital from two sources: investors (or donors) and customers.

With for-profit organizations, the understanding between investors and managers of the organization is that investors will provide enough capital to enable the organization to create value for customers. Over time, however, customers will ultimately be the source of the company’s capital. This understanding creates an incentive for managers to focus on creating as much value for the customers (their ultimate source of capital) as possible. When successful, investors receive a return on their investment and the cycle repeats itself again and again. Simplistically, this is the capitalistic engine. It is the greatest engine of wealth creation that humanity has ever built.

Nonprofit organizations are different. No matter how great a nonprofit organization is, its managers will mostly have to depend on donors for support as they rarely charge customers for the value they provide. This creates an incentive for nonprofits to design an organization that focuses on the needs of their donors, not the beneficiaries. When the needs of donors and beneficiaries clash, the donors almost always win.

The scalability of profits

When for-profit organizations solve a problem that impacts millions of people in society, such as diabetes in Mexico, their solution automatically becomes scalable. That’s because their source of capital shifts from a handful of investors, who manage the flow of capital, to the tens of millions of people who struggle with the problem. We refer to these people as nonconsumers: people who don’t have access to existing solutions because they are too complicated or expensive. By solving a problem for nonconsumers in a profitable way, organizations build a system that is sustainable and scalable.

The nonprofit model is different. The more successful a nonprofit organization, the less scalable it is because its success depends on the largesse of a handful of donors. Inherent in the business model of a for-profit organization is scalability as their funding comes from the millions of nonconsumers looking to solve their problem.

Profit creates wealth

Another reason for-profits beat nonprofits is that for-profit organizations create wealth. One of the questions I ask my students is: In solving the diabetes problem, would you rather take a job with a nonprofit organization that paid market rate or a for-profit organization that raised money from investors, had a path to profitability, and offered you some equity? The majority say the for-profit organization.

When innovators solve a problem using a for-profit model, they automatically create a wealth engine that increases prosperity in the region. Wealth increases salaries, generates taxes, and incentivizes more people to creatively solve problems in society.

Behind every nonprofit is a profitable company

This last point is quite simple. The path to every nonprofit organization effectively goes through a for-profit one. In essence, every nonprofit organization is funded by a profitable company or someone who has benefited from the wealth engine created by a for-profit organization. So, one can’t even start nonprofits designed to help the poor without having successfully launched for-profits in the past.

There is nothing inherently wrong with nonprofit organizations, although well-meaning NGOs sometimes do more harm than good. Many are well suited to solve problems that affect people on the margins: healthcare in rural areas, rare diseases, humanitarian disasters, etc.. But the nonprofit model is heralded in poor countries as the only suitable way to solve many fundamental societal problems and, unfortunately, that’s problematic. That sort of thinking undermines the most effective tool poor countries have to solve their problems: profit.